The Dow Jones Industrial Average (DJIA) is one of the world’s oldest stock market indexes. It stands as a powerful and influential indicator of the US economy and stock market. Over the years, the Dow has grown to comprise 30 of the largest blue-chip companies in the United States. It has offered investors a glimpse into the state of the US economy, although some consider it to be inaccurate. This article will provide an overview of the Dow, including its beginnings, recent trends and what it means for investors.

Origins

Charles Henry Dow created the DJIA in 1896, marking the beginning of a grand legacy. Initially, the index contained 11 transportation-related stocks. At that time, the American economy largely focused around the transport of goods. As the years passed, the Dow was changed, or “reconstituted,” to include higher profiles companies. Its name changed to the Dow Jones Transportation Average. Later, in the 1970s, it was renamed the Dow Jones Industrial Average, with its new composition reflecting the reshaped US economy. Today, the Dow constitutes 30 large-cap blue-chip companies, including giants such as Exxon Mobil, Microsoft, and Apple.

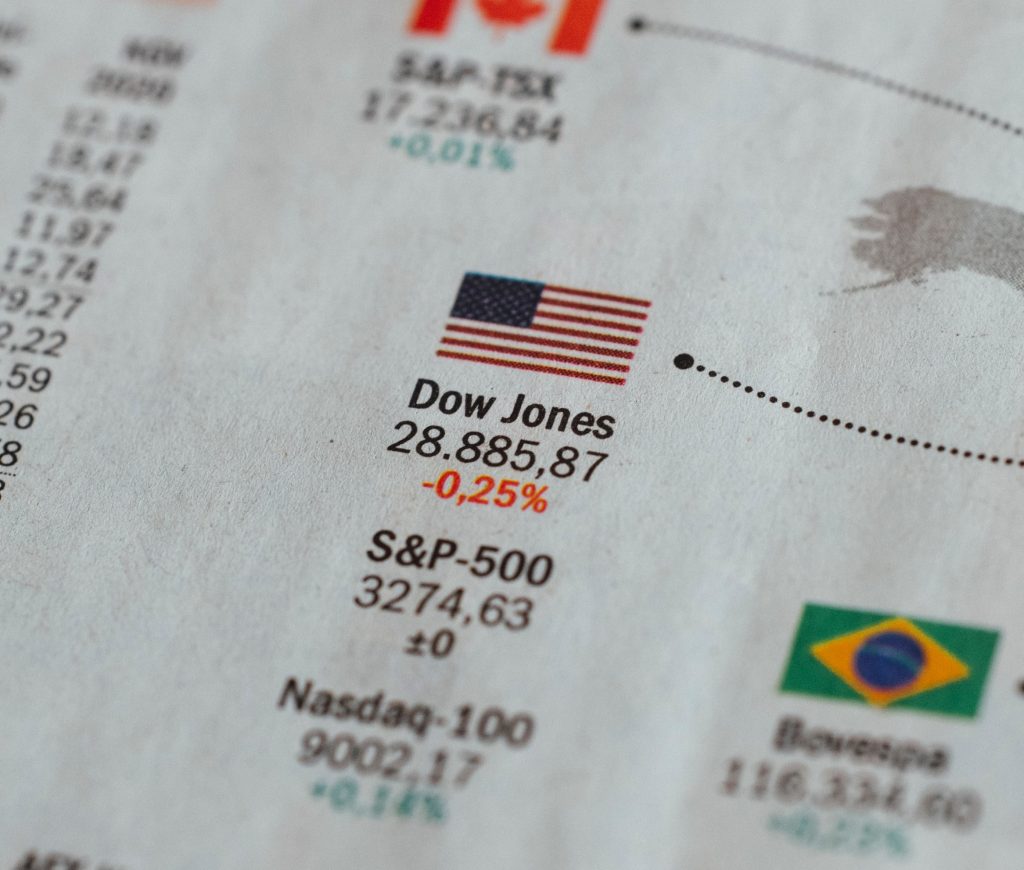

Of the many stock market indexes in the United States, the Dow Jones Industrial Average is one of the most popular and influential. This popularity is due to its price-weighted approach when determining its effectiveness as an indicator. Companies with higher prices make up a larger portion of the entire index, making their influence over its price movements much higher than their lower-priced counterparts.

How does it compare to others indexes?

Another important index is the S&P 500, which tracks 500 large-cap stocks and is often seen as a barometer of the overall US stock market. Other important indexes include the S&P Global 100, S&P Global 1200 and the MSCI USA Large-Cap Index. This range of indexes provides investors with a range of investment options for stocks in the US and worldwide.

When it comes to understanding and measuring economic growth, investor’s look to global stock markets indexes. These indexes, which are weighted by market capitalization, provide exposure to both emerging and frontier markets, as there are still some markets that are too small to be included in the index. Popular global stock market indexes include FTSE All-World Index, S&P Global 100 Index, and S&P Global 1200 Index.

As one of the world’s most influential SMIs, the DJIA offers investors insight into the health of the US markets. We consider The 30 Dow stocks to be blue-chip companies, meaning they have a history of stability and sustained growth. Additionally, the Dow’s price-weighted approach helps to ensure that stocks with higher prices have an influence on the Dow’s movements.

Things to keep in mind

When investing in stocks based on the Dow, it is important to consider market volatility, macroeconomic factors, and potential return on investment. These factors can cause the index to fluctuate over time, making these stocks less predictable than more diversified portfolios. It is also important to understand that the Dow is only one indicator of the US economy and stock market. While it may offer insight into the health of the US economy, it is important to look at other factors such as economic growth, consumer confidence, and housing prices.

Conclusions

In conclusion, the Dow Jones Industrial Average is one of the world’s most influential stock market indexes. The index offers investors insight into the health of the US economy and stock market. It has come a long way since its creation in 1896 and consists of 30 of the largest US companies. Most relevantly, it is price-weighted to increase the influence of higher-priced stocks. Investors looking to invest in the Dow should consider market volatility, macroeconomic factors, and potential return on investment. Additionally, it is important to look beyond the Dow and also consider other indicators of economic health, such as consumer confidence, housing prices, and economic growth.

This is a great article on the Dow! Definitely one of the most important and influential indices out there

I agree